Overview

IPO Costs on AIM

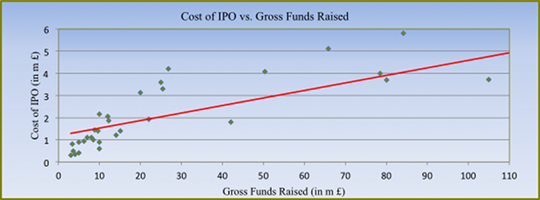

Given any level of gross funds raised, the offering costs for European companies listing on London's AIM can be predicted with 70% certainty as: Gross Funds Raised x 3.43% + £897,000.

Cost of IPO on London's AIM vs. Gross Funds Raised on London's AIM

The variability of the offering costs is directly related to the type of company that is seeking to list via an AIM IPO. For certain companies, the third-party due diligence is negligible and for others it is extensive and can include reports from technology experts, patent agents and/or reporting geologists.

| Category | Description | Amount |

| Gross Capital Raised | £16,000,000 for the London AIM-listed company and £8,000,000 for selling shareholders* | £24,000,000 |

| AIM Nominated Adviser | IPO oversight and regulatory obligations | 150,000 |

| AIM Nominated Broker | Capital raising commission @ 4% (range of 3% - 5%) | 960,000 |

| Lawyer | Agreements, due diligence, London AIM Admission Document, investor presentation and announcements | 250,000 |

| Reporting Accountant | Four Reports | 150,000 |

| Auditor | Audit of financial statements | 80,000 |

| Independent Equity Res. | Pre-IPO research | 60,000 |

| Financial PR/IR | Media training, financial and trade press coverage and London AIM regulatory announcements | 40,000 |

| Miscellaneous | Printing, AIM listing fee and out-of-pocket expenses | 30,000 |

| Net Capital Raised |

London AIM IPO Transaction Costs

Approximate 7.17% |

£22,280,000 |

* Financial investors can typically exit entirely at the time of the AIM IPO and insiders / executive management can typically sell down 20 - 25% of their holdings, all on a case-by-case basis. A free float of at least 25% is desirable with 50% being ideal so as to increase the chance of achieving strong aftermarket liquidity on London's AIM and the derivation of a ‘fair’ share price / market cap.